In an era marked by escalating climate risks and rapid technological advancements, traditional insurance models often struggle to provide timely and adequate coverage. Parametric insurance has emerged as a transformative solution, offering swift payouts based on predefined triggers rather than assessing actual damages.

???? What Is Parametric Insurance?

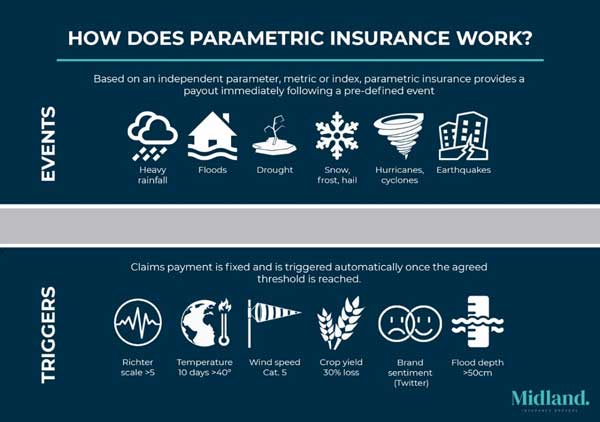

Parametric insurance, also known as index-based insurance, provides predetermined payouts when specific parameters—such as wind speed, rainfall amount, or earthquake magnitude—reach or exceed agreed thresholds. Unlike traditional indemnity insurance, which compensates based on actual losses, parametric policies focus on the occurrence of an event as defined by objective data sources .mapfreglobalrisks.com+1en.wikipedia.org+1corporatesolutions.swissre.com

???? Real-World Applications

- Climate Risk Coverage: In Kolkata, India, insurers have introduced parametric policies to protect residents from extreme weather events like heatwaves and heavy rainfall. These short-term policies, lasting from a day to a month, utilize data from the Indian Meteorological Department to determine payout triggers, simplifying the claims process and offering compensation for increased living expenses and income loss .timesofindia.indiatimes.com+1timesofindia.indiatimes.com+1

- Agricultural Protection: Farmers in drought-prone regions can benefit from parametric insurance that triggers payouts based on rainfall deficits, ensuring timely financial support to mitigate crop losses.time.com

- Disaster Response: Countries like Tonga have utilized parametric insurance to receive immediate funds following natural disasters, enabling swift recovery efforts without waiting for damage assessments .en.wikipedia.org

✅ Advantages of Parametric Insurance

- Rapid Payouts: Since claims are based on objective data, payouts can occur within days, facilitating quicker recovery .mapfreglobalrisks.com

- Transparency: Clear parameters and predefined triggers eliminate ambiguity, fostering trust between insurers and policyholders.

- Cost Efficiency: Reduced administrative processes and faster claims settlement can lead to lower operational costs and potentially more competitive premiums .mapfreglobalrisks.com+1economictimes.indiatimes.com+1

- Broader Coverage: Parametric insurance can cover risks that are difficult to assess with traditional methods, such as certain climate-related events or geopolitical risks.

⚠️ Considerations and Limitations

- Basis Risk: There’s a possibility that the event may not cause actual damage despite meeting the trigger parameters, leading to payouts without corresponding losses.

- Data Dependency: Accurate and timely data from reliable sources is crucial for determining triggers and ensuring fair payouts.

- Complementary Role: Parametric insurance is often used alongside traditional insurance to address gaps, rather than replacing it entirely.

???? Conclusion

Parametric insurance represents a significant evolution in risk management, offering timely and transparent coverage tailored to modern challenges. As climate-related events become more frequent and severe, this innovative approach provides a valuable tool for individuals, businesses, and governments seeking to enhance resilience and ensure swift recovery